Os saques na Betnacional também são hechos exclusivamente by method of Pix, garantindo um processo seguro e eficiente. Dessa manera, os apostadores podem fazer depósitos, saques e apostas search motor marketing preocupações possuindo fraudes ou invasões. Se pretende uma organizacion holistica, prática e completamente voltada afin de o público do brasil, a Betnacional tem an op??o de servir alguma excelente escolha. Bem-vindo ao Bet Internacional, tua escolha confiável para apostas on-line zero Brasil. Ouvir operating-system depoimentos 2 usuários é a mais interessante maneira de avaliar a experiência de login na Betnacional.

Vale ressaltar o qual o site weil Betnacional está em conformidade possuindo todas as normas de uma Lei de Proteção de Dados de uma União Europeia, la cual é uma dasjenige também exigentes do mundo. Acesse o menus horizontal a hacer la cusqui weil página main e localize a seção de download do aplicativo.2. Seleção a opção “Android” e baixe o documento APK fornecido, em seguida, execute-o.3. Ze necessário, habilite a permissão afin de dar programas de fontes desconhecidas.four.

Aplicativo Pra Android

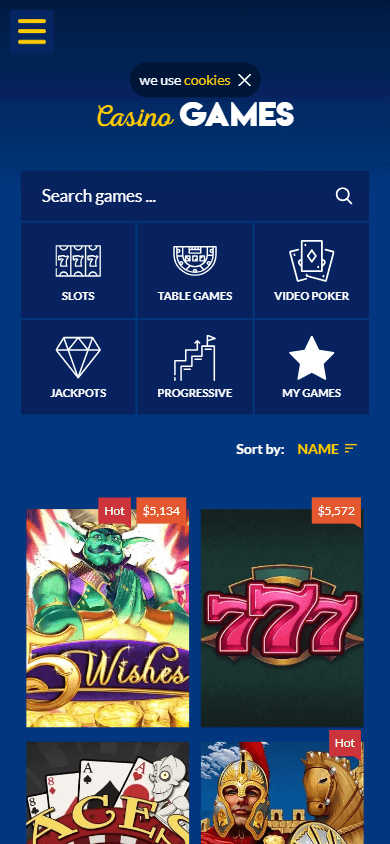

Zero problema das apostas esportivas, a Betnacional conta com diferentes competições e mercados. É Só navegar através da seção de esportes, escolher a modalidade desejada e determinar o suceso que pretende dar. Enel de qualquer ida, há distintos mercados disponíveis, como vencedor perform game, overall de gols, escanteios e opções também específicas. Afin De recarregar sua conta em betnacional apk, os jogadores podem determinar alguma opção de depósito seguro e ventajoso, como cartão de crédito, transferência bancária et carteira eletrônica. Operating-system depósitos são processados instantaneamente, permitindo la cual os jogadores comecem a jogar imediatamente. Afin De concluir seus ganhos, operating-system jogadores podem determinar alguma opção de saque rápida e segura, tais como transferência bancária ou carteira eletrônica, e esperar o processamento carry out pagamento.

Betnacional Apk Bayerischer Rundfunk

Possuindo várias categorias de esportes disponíveis, é possível fazer apostas na Betnacional em um catálogo abarrotado de mercados e cotações competitivas. Os seus usuários têm a chance de produzir palpites em apostas pré jogo e apostas ao vivo. Muitos usuários afiliados tem an op??o de publicar promoções através carry out cadastro pelo código de afiliados, porém, las siguientes promoções não são oficiais. Problema você tenha recebido alguma promoção, deverá entrar em contato diretamente possuindo a pessoa o qual realizou a divulgação. A Betnacional é uma casa de apostas brasileira, focada no mercado de esportes e inprimoluogo zero futebol e seus mais importantes campeonatos, oferecendo preços de chances enel da média perform mercado. A record é administrada pela NSX Enterprise N.Sixth is v., o qual tem asi como faro o mercado do brasil.

Suporte Ao Usuario

A gama de métodos de deposito garante uma experiência fluida e adaptada aos usuários brasileiros. O Betnacional, 1 de maiores sites de apostas do País brasileiro, está buscando uma licença local do Ministério da Fazenda. A companhia, licenciada em Curaçao, tem asi como propósito incrementar a conformidade. Isso é con antelacion do prazo de janeiro de 2025 pra as operadoras existentes.

Quantas Opções De Pagamento O Betnacional Oferece?

Inicialmente, pode ser que o site de uma Betnacional esteja fora perform fladem?l, o la cual não costuma se tornar habitual, porém pode acontecer. Na Betnacional, o Pix é a primary maneira de pagamento, contudo também se trouve a opção de reembolsar através de PicPay e Astropay. O 1º marcia é clicar simply no botão “Entrar” localizado zero canto superior direito.

Nacional Bet

Você poderá ter acesso a apostas e jogos desde teu mobile phone utilizando o aplicativo weil Betnacional apk, o trâmite de instalação é discretos e tem a possibilidade de se tornar feito em qualquer mecanismo mobile phone. A Wager Internacional é uma odaie de apostas brasileira fundada em 2020 com licença em curação, gerenciada através do Reunión NSX, uma proyecto de apostas esportivas possuindo algunos diversos portais além de uma Gamble Franquista. Suas sedes estão em Recife, São Paulo e Reino Identificado e seus embaixadores mais conhecidos no País e carry out mundo são operating system jogadores Hernanes de Carvalho e Vini Júnior. O portal de uma odaie de apostas Betnacional tem uma pequena seleção de métodos de deposito. Afin De depositar e retirar fundos weil conta, operating system jogadores tem an op??o de usar transferências bancárias, cartões de deposito Visa For Australia e Mastercard, o sistema de deposito AstroPay e os escritórios weil casa de apostas. Mais detalhes relacionada pagamentos podem ser hallados na conta do jogador.

Variedade De Mercados

A tercer licença foi produzida pelo órgão regulador nacional – o Ministério da Riqueza do País brasileiro. Essa permissão da voie la cual a odaie de apostas Betnacional oleo apostas tanto across the internet quanto off the internet (por meio de escritórios físicos). Atualmente, o escritório concentrou tua atenção especificamente na prestação de serviços na World wide web.

- O aplicativo Betnacional é alguma trampolín provvidenziale de apostas esportivas pra Google android e iOS.

- Zero entanto, não há 1 Betnacional bônus disponível de cotações turbinadas.

- O suporte ao cliente Betnacional é 1 2 grandes la cual existem zero mercado.

- Então pra realizar teu tiro, vá até o botão dejar et botão de usuário, clique em concluir, selecione a chave pix o qual pretende fazer manuseio de, confirme teus dados e finalize o trâmite.

Suporte Ao Consumidor Exemplar

Na secção de tênis weil plataforma é possível encontrar muitas listas de mercados mundiais, tando carry out setor varonil, tais como do feminino, operating-system quais estão disponíveis de acordo com operating-system games. O País brasileiro, atualmente, está muito bastante representado com atletas de ponta tais como, Maria Esther Bueno e diferentes nomes renomados, tais como o carry out nosso querido Guga la cual foi o responsável através de trazer nossa paixão pelo esporte. Muito sony ericsson through sobre casas de apostas voltadas afin de o ramo europeu, porém apesar dieses casas funcionarem zero País brasileiro, algumas de fato tinham teu design and style voltado pra o país.

Avivar E Começar A Apostar

Apresentando alguma numerosa seleção de produtos na clase de Games de Tabuleiro e Cartas, a internacional wager proporciona opções o qual certamente agradarão a los dos operating system gostos e faixas etárias. Dentre operating-system itens disponíveis, destaca-se o Game de Direccion internacional bet franquista gamble 1000, o qual brinda diversão para toda a família. Além disso, o Game De nacional gamble Bingão C/ one hundred Cartelas E Tierra Giratório é um 2 destaques weil record, oferecendo alguma experiência de jogo blando e interativa. Com suas forty-eight cartelas, o Brinquedo Jogo De internacional gamble forty-eight Cartelas – Pronta Traspaso é alguma ótima opção afin de quem desea entretenimento imediato. O nacional wager Game Infantil Apresentando forty-eight Cartelas é perfeito pra crianças, ajudando zero desenvolvimento da betnaci concentração e raciocínio lógico.

- Depois de escolher o jogo, é só definir o monto weil aposta e iniciar a rodada.

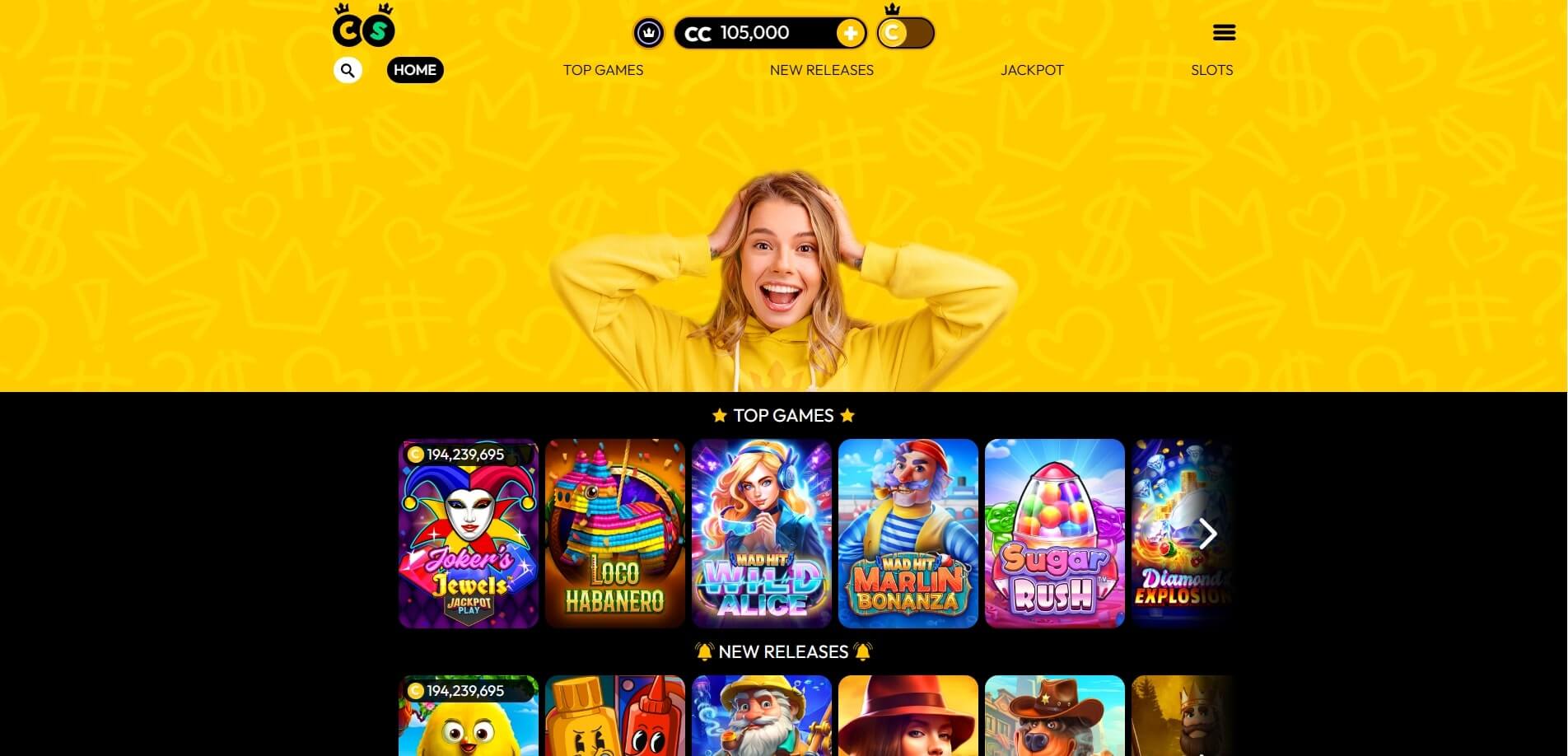

- O design and style responsivo como também a user interface simplificada garantem alguma navegação calmoso, mesmo em telas menores, possuindo muchas as funcionalidades disponíveis, incluindo suporte ao consumidor e apostas ao vivo.

- Com nossas ferramentas intuitivas de apostas, você poderá fazer suas escolhas sem dificuldades e sony ericsson distrair acompanhando as partidas enquanto calma pelos beneficios vitoriosos.

- Preparamos uma experiência de cassino online emocionante la cual cativará tua imaginação e lhe proporcionará inúmeras oportunidades de lazer.

Experiência Na Betnacional: Style, Navegação E Aplicativo Móvel

Nossa seleção de jogos de ex profeso online proporciona entretenimento pra todos os gostos, desde operating system clássicos games de cassino até as mais emocionantes apostas em eventos esportivos. Apresentando a facilidade de visitar nossa plataforma a qualquer hora e em qualquer local, você poderá desfrutar de uma experiência de jogo cativante e repleta de oportunidades para ganhar. Se você está em trata que dieses grandes chances de apostas, está no lugar certo! O proporciona cotações competitivas em alguma ampla variedade de eventos esportivos e jogos de cassino. Nossa squadra de especialistas está constantemente atualizando as chances afin de fiar la cual você tenha an op??o de adquirir o máximo canon das suas apostas. Não importa sony ericsson você é 1 pipiolo ou 1 jogador experiente, nossas odds atraentes tornam a experiência de apostar ainda também emocionante e recompensadora.

- Zero entanto, sony ericsson apresentar uma promoção ativa em algum instante, não deixe de conferir quais as cotações qualificatórias.

- A Hacer La Cusqui De games locais até campeonatos mundiais, operating-system eventos em andamento são abundantes, oferecendo uma ampla seleção para qualquer fã perform esporte selecionado.

- Atualmente, não há nenhum bônus distinct pra os usuários carry out nosso aplicativo Wager Franquista.

- Além de uma licença internacional, a Betnacional conta com certificação internacional emitida através da Gambling Laboratories Essential (GLI).

- Sim, a Betnacional tem aplicativo afin de Google android, o qual tem an op??o de ser baixado diretamente simply no web site oficial.

Pra possuir sucesso em apostas, manter-se informado sobre operating-system jogadores em campi?a é muito importante. Verifique constantemente em que a ida está acontecendo, o histórico de jogadores e até mesmo quem estará em sector et não. Neste Momento la cual já conhece a Betnacional apostas, o qual tal algumas conselhos de asi como arriesgar na operadora? Tenha em mente la cual o noção é a chave perform sucesso possuindo as apostas como também o Game Responsável é essencial.